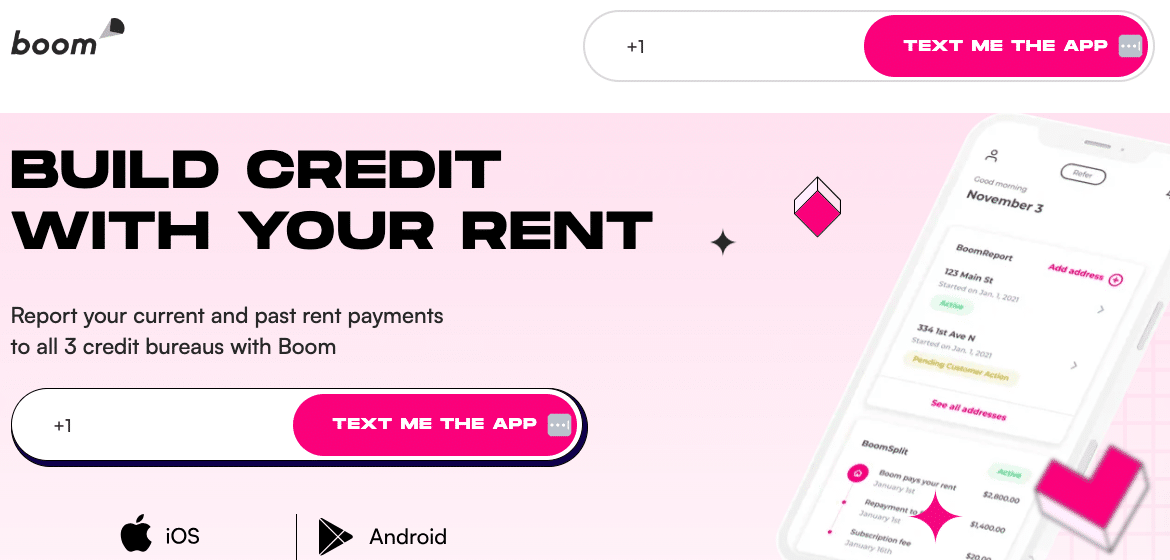

If you want to improve your credit score, Boom is one of the best rent reporting services that you should consider.. Rent reporting is a novel method of establishing and monitoring creditworthiness. Boom reports your rental payments to the three major credit bureaus – Equifax, Experian, and TransUnion – so that you can establish a good rental payment history and improve your credit score.

In addition, Boom rent reporting allows you to track your credit history in real time, making it easier to assess the impact of any changes on your score. The entire process is pretty straight forward. In this article we’ll demonstrate how it works.

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

What is Boom?

Boom is a rental payment app that provides two services: BoomReport and BoomSplit. It’s headquartered in Glen Cove, NY, and founded by Rob Whiting and Kirill Moizik.

You can use BoomReport for reporting your ongoing rent payments as well as your past rent history going back up to 24 months – to all three credit reporting agencies.

And with BoomSplit, you can divide your rent payment into several monthly payments. Boom will pay your landlord a lump sum on the date you’ve agreed upon.

Pros

- You can add up to 24 months of previous rent payments.

- Adding your rental payment history costs only $25.

- Allows you to quickly build credit.

- The BoomSplit feature allows you to split your rent payments.

- Keep track of ongoing payments.

Cons

- No free trial

- Still a new player in the space

- Limited number of reviews

How BoomReport Works

Boom is available in the App Store and Google Play. To create an account you need to provide the following information such as your age (must be over 18), a social security number, and a formal rental agreement in the last 24 months.

Important details you need to know

Late payment reporting

It takes 30 days after the due date for the credit bureaus to consider a payment to be past due. Less than thirty days after the due date, rent payments will be recorded as timely.

Your credit may be affected if you make payments more than 30 days late. Boom advises limiting your reporting of previous payments to leases for which you have a perfect track record of on-time payments.

How BoomSplit Works

A lease, sublease, or roommate agreement may govern your rental arrangement. It needs to be clear who you are renting from, where you live, and how long your lease is for.

Even if your previous lease has expired and you no longer reside at that address, you can still report it.

Boom will check your bank’s records to confirm your payments and your lease. After verification, they will report up to 24 months’ worth of rent payments to Experian, Equifax, and TransUnion, the three main credit reporting agencies.

After they have verified your information and submitted your record to the credit bureaus, the new tradeline will typically appear on your credit report and start to affect your credit score within 7 to 10 days.

Verification and submission typically takes four days, so your credit score could change in as little as two weeks in theory.

Rent must be paid through a rental portal like RentCafe in order to use the BoomSplit service.

Your payment can be split up into a number of smaller payments with BoomSplit. It’s perfect for renters who want to deduct a portion of their rent from each paycheck and are paid weekly or biweekly.

Boom will send your landlord a single timely payment. Depending on the timetable you decide upon, you can repay Boom. If you run behind, you can work out a payment plan with Boom to stay ahead of things and avoid incurring late fees and the stigma associated with them.

Boom will prevent payments from being taken out of your account if you don’t have enough money to cover them, saving you from expensive overdraft fees.

Your landlord is not required to approve of or take part in the BoomSplit service

Building Credit with BoomReport

Boom has the ability to add a tradeline with a maximum two-year payment history to your credit score report. Although there will be a positive effect, many different factors will determine how big that effect is. According to Boom, they anticipate the rise to be between 10 and 100 points.

Just like any method for building credit. The effects will be most noticeable for those who have a thin credit file, a brief credit history. Lack of credit history or a history with insufficient information to calculate a score could mean the difference between having a score and not having one.

Pricing

At just $2/month when you subscribe for a year ($24 annually), Boom is one of the most reasonably priced rent reporting services on the market. It’s also one of the few rent reporting services that reports to all three credit bureaus, so your payment has a greater impact.

Boom is also a bargain for staying organized and keeping track of your ongoing rental payments. You can report ongoing payments and gain access to useful features such as rent reminders and payment history for that bargain basement price. You can also cancel at any time if you are unhappy with their service.

Boom Alternatives

Rent reporting services have been around for a while. Some of the more popular alternatives to Boom would be companies like Rent Reporters, Credit My Rent, Rent Track, and Rental Kharma. Historically, these companies have charged relatively high fees for their services and report to only one or two credit bureaus which really limits their overall appeal.

How Boom Stacks Up to the Competition

In as little as two weeks, Boom can add up to two years’ worth of rental history to your credit report, followed by ongoing rent reporting. Although there is a cost, it is significantly less than that of the majority of the competition. It’s one of the most reasonably priced rent reporting services we’ve seen.

There are a few drawbacks. Although the low price makes up for it, you won’t receive a discount if you add your spouse, partner, or roommate to your account. Your credit may be impacted by late payments.

Conclusion

The Boom app can help you quickly build credit and save money on more expensive services thanks to their flat monthly membership fee and support of reporting to all three credit bureaus. If you’re looking to build your credit and split your rental payments, the Boom app is definitely one of the best rent reporting services you should consider.