Credit scores wield significant influence over many individuals’ lives. A diminished credit rating can hinder approval for vital assets like homes or cars, particularly when debt is substantial. Consequently, a favorable credit rating holds paramount importance, not only for individuals but also for businesses. In the realm of credit repair applications, Dovly stands out as a premier choice. In this article we’ll examine the tool to help you if it’s the right one for you.

What is Dovly?

Dovly can help you improve and repair your credit score. The firm offers both an online site and an app that its users can download in the hopes of interacting with their product. What makes the software unique are the automatic workability as well as the free credit repair solution provided by Dovly. They say it helps customers with credit repair costs. Dovely can easily fix your bad credit history for you by calling credit bureaus. According to Dovly, 99% of users get credit boosts compared to 56. This means that good credit scores are in an ideal range or poor credit scores are in an acceptable range.

Dovly does more than simply provide credit monitoring services. Instead, it offers a credit repair service that displays items that impede your account balance and then disputes those items once it receives your approvals. The company has rejected nearly 1 million credit-card fraud complaints in its first two years. Dovly boasts a 99-percent success rate and has also increased its credit score by 53 points within six months. Dovly was based in a partnership between several financial institutions including Even Financial Inc. In June 2020, the startup was funded through seed money in June 2020 for $3 million. Those funds will be used to promote or develop products.

What service does Dovly offer?

Dovly provides one single service — credit repair. This service is offered on a variety of levels. Dovly’s credit repair service is designed to identify and fix issues with all three credit reporting agencies: Experian, TransUnion Equifax, and Xero. However, they only submit a single complaint a month. You will receive three disputes monthly on all three credit reports, access to a theft protection policy, and enhanced credit monitoring to protect your identity. Ultimate Services add unlimited disputes each month.

How much does Dovly cost per month or annually?

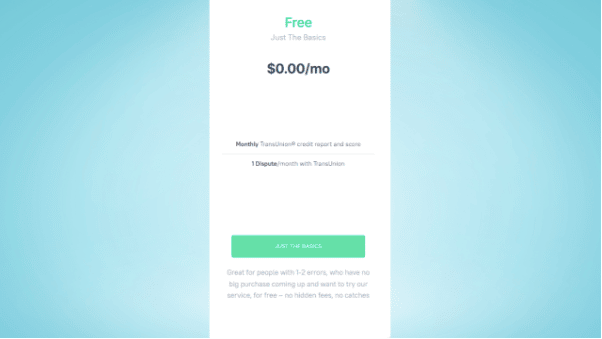

Dovly also offers three different rates. Each has been tailored to the specific objectives of your credit problems. Everything begins with a free plan. When a product needs some more power, you can upgrade it. Here is the list of their payment plan:

Free plan: completely free

- Single Dispute per month with TransUnion

- TransUnion monthly credit report

- No installation fees

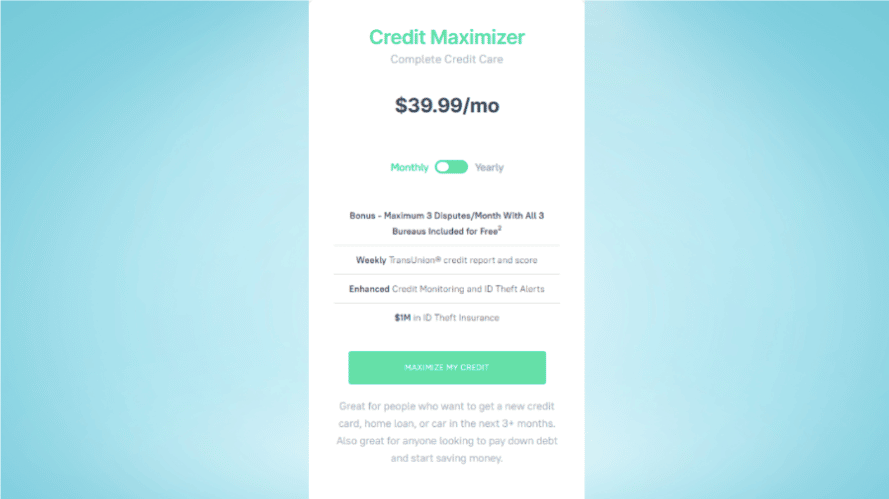

Credit Maximizer Premium Plan: $39.99/monthly

- Maximum 3 Disputes with all three credit bureaus

- Ultimate plan all features

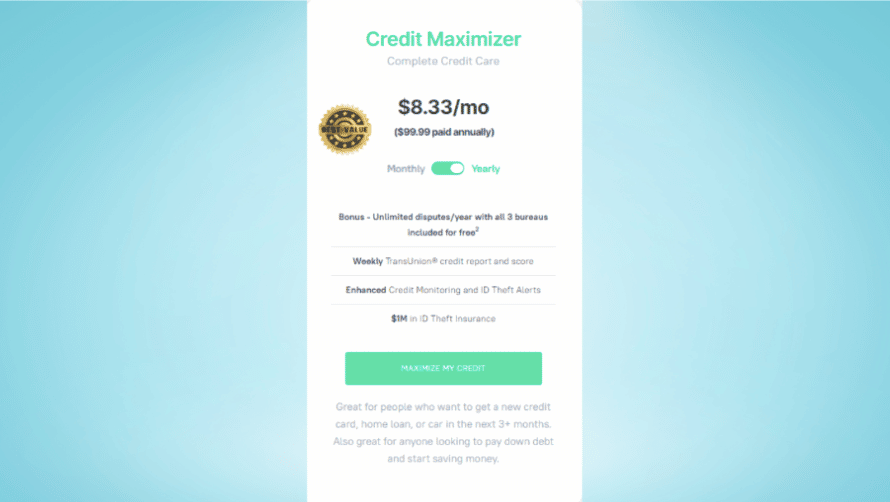

Credit Maximizer Ultimate plan $8.33/monthly fee or $99/annual fee

- Weekly TransUnion credit repair and score

- Enhanced Credit Monitoring and ID Theft Alerts

- $1M in ID Theft Insurance

- Unlimited disputes with all three credit bureaus

Dovly provides its clients with excellent pricing options compared with others in this category. You will get many quotes from other other credit repair businesses, so it is possible to compare different prices. They also provide many features that other credit repair services do. If you need help getting a better credit score, we recommend Dovly. No disappointment.

Who should use Dovly?

If you have had to dispute an unsatisfactory credit rating based on your credit history and/or bank account history, Dovly will be the right place to start. The free tier permits you to file a dispute every month with TransUnion with no credit card info. Among its other customers is an 87% satisfaction rate with a score gaining as much as 85% over the past month.

Pros and Cons – an honest dovly review

Pros

- Less expensive

It’s cost-effective to deal with an experienced and reliable debt repair company in your area. Installation fees alone could be as much as $99. It’s also possible to spend $50 to $150 per month on many popular credit repair services. Hence, if a person chooses a credit repair service they may spend somewhere between $200- $1,000 over the next six months. Based on your credit rating, it can take up to 6 months to resolve the problem. With a simple and easy use of Dovly, it is possible to fix credit without cost. The pay version is less expensive at $99.95 annually for deluxe plans or about $240 per year for deluxe plans. - Dovly uses Vantage Score 3.0, Not FICO

We learned recently that 90 percent of lenders are utilizing FIICO scores in determining loan approval. Dovly uses a Vantage score of 3 to avoid reversibility. Vantage scored a 3.0 education credit. This should give you an idea of what your position is, but this won’t be the score the lenders want. These differences can be significant because they are measured in different ways; the corresponding results can differ. This can be used as the best service for credit in buying and obtaining an automobile. - Fully automated credit improvement platform

It can be done by anyone else for repairing unsecured debts. Most good credit recovery programs require you to send physical letters to the credit bureaus or manually report the dispute to them in their systems. No. Very simplified. Dovy can resolve any disputes with you. It is up to you to find negative items that need to be corrected. We do not send emails. No automated data entry. We will track all disputed cases and notify you of any changes to your credit history. - Easy registration

Dovly helps you with the credit repair process. It integrates with Android and Windows, so you can easily add information without the need for an account. It will give you personal details such as a contact number and email. Tell the authorities about the information and the identity. So a few people ask if you want credit. Goals. Needs. They then immediately search out the credit reports and dispute them. You can get started immediately with the dovly credit repair engine. - Free service using a free plan

The program will give you an idea of what Dovly can do. The free stuff is amazing! No personal financial information or unauthorized access is permitted. But these Free Plans are quite limited when compared with both. The company does not file disputed claims with TransUnion and you receive only 1 dispute each week. Credit Bureau credit report and scores will be updated at the end of the month. - Excellent customer reviews

A way to know how much an organization does is by reviewing the customer experience. Dovly has customers who praise them through Yelp Credit Reviews, TrustPilot, and the Better Business Bureau. At the time this report was published, their scores were below average. This speaks to how they run their business.

Cons

- Limited monthly disputes

One common disappointment which comes up during most negative reviews is the limits on disputes even for premium subscription users. Dovly limits premium customers to three monthly dispute resolutions by creditor agencies. Customers with free versions only have a single dispute per month, which is limited to Transunion. If you are looking to improve your credit score, you will probably need to upgrade to the Ultimate or Premium plan. For customers who had numerous negatives they couldn’t contest, that may not be enough. Tell me the reason behind Dovly’s decision. The researchers are doing research. - The Premium Version Isn’t Available In All States

Free versions of Dovly are available across every state and District of Columbia. As we have previously stated, the premium version is needed if a consumer is looking at disputing credit reports from other banks. Fortunately, there is an update available for users with more power.

Dovly vs. some of its competition

Credit Repair.com

CreditReparation has been offering services for many years and customers praise the educational resources offered by the organization. In April 2019, consumers sued Credit Repair.net over a violation of telemarketing laws affecting its customers. CreditRepair.com can also dispute items to you. The basic package has a monthly cost of $99.95 and consists of a starting cost of $99.95. It costs you 919.00 a month plus the same amount to start. The highest tier is $99.98 annually, plus the startup cost is $199.95. None of them offer a money-back guarantee.

Credit Saint Laurent

CreditSaint offers three payment types but compared to CreditRepair.com, they provide a 90-day refund policy. Credit Polish is available in five disputes at $799 monthly plus $999 startup fees for each dispute if the dispute is settled in writing. Credit Remodel allows for ten disputes monthly for $99.99 per week plus an additional $199 startup fee. The most expensive Clean Slate level includes free legal disputes at $119.99 monthly along with a start-up fee. Generally, letters of cessation or desist are included in every category.

Credit Karma

Credit Karma is a constant credit monitoring company. It provides access for free to your credit score and reports from TransUnion and Equifax and helps to determine the impact that various credit information may have on your credit score. Credit Karma provides tools to dispute credit report errors but does not automate this or focus so strongly on improving credit rating. Credit Karman also allows you to find credit information for your bank accounts or credit cards, making it the ideal choice for people looking for financial service recommendations.

Credit Repair Cloud

Credit Repair Cloud is a dynamic and all-encompassing software solution that empowers both individuals and businesses to embark on the journey of credit repair with confidence and efficiency. With its user-friendly interface and robust features, Credit Repair Cloud enables users to initiate, manage, and expand their credit repair services seamlessly. From analyzing credit reports to generating personalized dispute letters and progress tracking, the platform offers a comprehensive toolkit to address inaccuracies and enhance credit profiles. Whether for individuals seeking to improve their financial standing or entrepreneurs venturing into the credit repair industry, Credit Repair Cloud provides the essential resources to navigate the complexities of credit repair and achieve tangible results

DisputeBee

DisputeBee is a versatile credit repair software that simplifies the process of rectifying credit inaccuracies and elevating credit scores. Designed for individuals and professionals alike, DisputeBee offers an intuitive platform to systematically identify errors, generate tailored dispute letters, and monitor progress. With its user-friendly interface and automation capabilities, it empowers users to take control of their credit improvement journey, making it an indispensable tool for those looking to enhance their financial well-being through effective credit repair strategies.

Credit Versio

Credit Versio stands as a comprehensive credit repair software solution, catering to individuals and businesses alike, providing them with the tools and guidance necessary to navigate the intricacies of credit repair, dispute inaccuracies, and foster the growth of improved credit profiles.

How can I join Dovly Credit Repair?

You can join very quickly. You only visit this website for enrollment. For an initial start, you will want to visit Dovly and select a plan. Free plans and premium plans are available for 39.99 per month, while Ultimate plans cost 99.99 annually. Once a decision has been made you will be emailed. Please give us a few basic info like a name and a phone number. If you have an ID you must also provide it to Dovly to get the credit report back. When you select your plan, Dovly will show you what things in your credit report can negatively influence your score. Tell Dovly if there are any disputes. Dovly works with you to increase credit scores.

Conclusion

Credit improvement takes time but it’s worth it especially to be free. It is very efficient to track your credit score by automating credit improvement. It also helps monitor credit reports and balances on the dashboard. Dovly has many features which other credit repair solution company lacks. My only criticism is I want more free plans. All things considered, I am happy with Dovly and would recommend it to anyone looking to improve their credit score.

FAQ’s

Does Dovly have an app?

It’s free. And it’s free of charge. The user-friendly app has been released by the Appstore and Google Play. Once you become a Dovly member, the app will connect to your credit report.

Does Dovly work?

The company has an 89% success rate and its members start seeing its credit score increase within six months and some see improvement within 30 days. Are the refunds offered by Dovly? Yes, both pay plan offers have 90-day money-back guarantees.

How long does Dovly take to dispute?

These processes can take between 30-40 days based on a dispute, but they can cause further delays. Example 1: Even if your negative marks are corrected, some things could affect your scores.

Is paying someone to fix your credit worth it?

Saving money by paying credit repair companies to repair your report can often be costly since you can easily dispute information about your credit history. The information will only be discarded or altered by an error.