If you’re on a quest to enhance your creditworthiness, Kikoff might just be your golden ticket. This innovative credit building app has been gaining significant traction in recent years, and it’s not by accident.

Kikoff offers not one, but two incredible services designed to help you build credit and empower you on your path to financial success.

In this review, we leave no stone unturned, answering all your questions about Kikoff and helping you determine if it’s the right fit for your financial aspirations.

Kikoff

Kikoff is a credit building service based in San Francisco that was founded in 2019. It offers consumers who want to build a stronger credit history and improve their credit score an easily accessible credit line.

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

What is Kikoff?

Kikoff is more than just a credit building service; it’s a financial ally headquartered in San Francisco and founded in 2019.

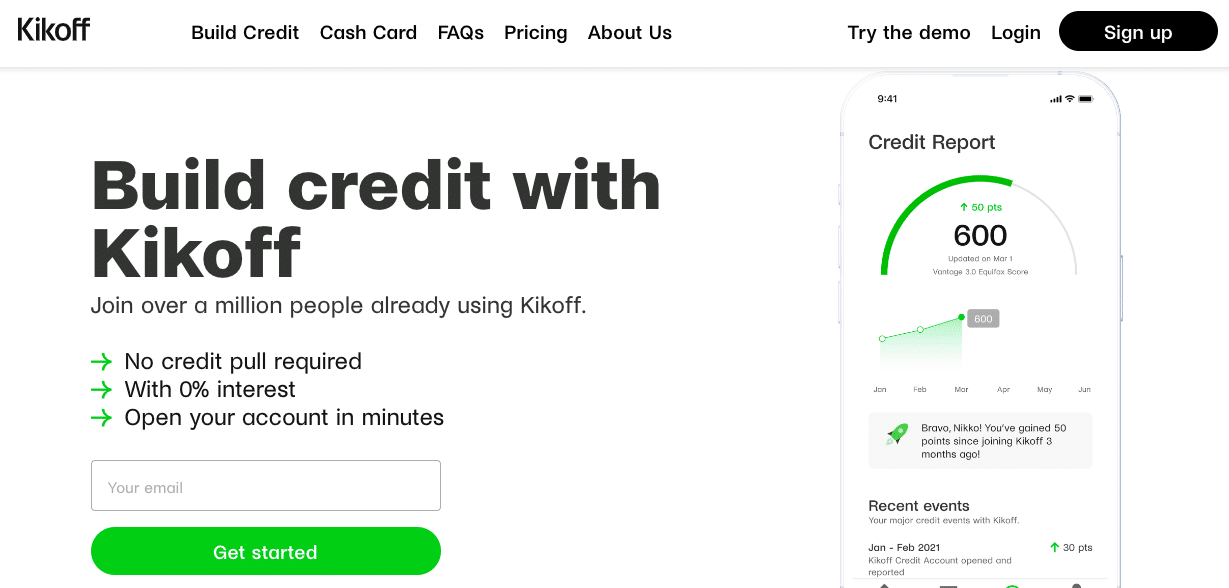

With Kikoff, you gain access to an easily accessible line of credit, paving the way for a stronger credit history and an improved credit score.

But here’s the kicker – Kikoff has streamlined the process, allowing you a credit limit of $750 for purchases from their online store.

You can comfortably repay this loan in small, manageable amounts, while Kikoff dutifully reports your payments to all three major credit bureaus.

It’s worth noting that Kikoff charges a modest $5 monthly membership fee, which is seamlessly applied to your credit line.

Kikoff's Dynamic Duo: Products

Kikoff boasts two exceptional products, each tailored to cater to your unique financial needs:

Kikoff Credit Account

This revolving line of credit is your ticket to building a solid payment history and reducing your credit utilization. It’s the ideal starting point for those looking to embark on a credit-building journey.

Kikoff Credit Builder Loan

For customers who have consistently made on-time payments with Kikoff products, this one-year savings plan is a game-changer. For just $10 per month, you can accelerate your credit-building efforts and secure your financial future.

The Kikoff Advantage

Now, let’s delve into why Kikoff stands out as a prime choice for credit improvement:

No Credit Checks

Say goodbye to the worry of credit checks. They don’t require one, making it the perfect choice for those who’ve faced challenges securing credit due to poor credit or a limited credit history.

Credit Building Expertise

Kikoff is your trusted partner on the road to better credit. All payments are meticulously reported to Equifax and Experian, progressively building your credit over time. Plus, they’ve got your back with friendly payment reminders, ensuring you stay on track.

Credit Limit Flexibility

While Kikoff’s credit lines are capped at $500, there’s no restriction on how much you can pay each month. This flexibility puts you in control of your credit journey.

Exclusive Kikoff Store Access

Your credit line can only be used at the Kikoff online store. While the product range isn’t explicitly listed on their website, they do offer budget-friendly options like e-books starting at just $10, as per their blog.

No Interest Charges

Unlike traditional lenders, you won’t be burdened with high-interest rates. Your monthly payment is a mere $2, and there are no hidden costs or interest charges.

Fast Credit Reporting

It may take a few weeks (up to six) for your new account to appear on your credit report after signing up. Patience is key, and the rewards are worth the wait.

No Prepayment Penalty

Should you choose to pay off your Kikoff balance early, there are no fees involved. Your financial freedom is yours to control.

Applying for Kikoff: Quick and Easy

To kickstart your credit journey, all you need to do is create an account. While there’s no credit check, you’ll still be required to provide some basic information like your email address and Social Security number.

The good news? Once you submit your details, you’ll receive a swift decision and immediate access to your credit line.

Is Kikoff Right for You?

Compared to other credit-building options, Kikoff stands out as an incredibly cost-effective choice. With a mere $5 monthly payment for the credit account and zero administrative, annual, or late fees, it’s budget-friendly.

Plus, the 0% APR on their products is the icing on the cake. If you opt for both a Kikoff credit account and a credit builder loan, you’ll have payments reported to all major credit bureaus – Equifax, Experian, and TransUnion.

Traditional lenders typically demand good to excellent credit scores (typically around 670) for approval, but Kikoff doesn’t even require a credit history – making it accessible to virtually anyone.

A Few Considerations

While Kikoff offers exceptional benefits, it’s essential to consider its limitations:

Exclusive Store Access

Your Kikoff line of credit is only valid for purchases at the Kikoff store, which means you can’t browse their product selection until your account is open.

Credit Builder Loan Requirement

If you’re not interested in a line of credit and want a credit builder loan, you’ll need to open a credit account first.

State Restrictions

Unfortunately, Kikoff is not available in Indiana and Delaware.

Frequently Asked Questions (FAQs)

Is Kikoff suitable for people with no credit history?

Yes, Kikoff is an excellent option for individuals with no credit history, as it doesn’t require a credit check for eligibility. It’s designed to help you establish and build your credit from the ground up.

Can I use my Kikoff credit line for any purchases?

Your Kikoff credit line can only be used for purchases made through the Kikoff online store. While the specific product range is not displayed on their website, they do offer various items, including e-books, starting at just $10.

Are there any hidden fees or interest charges with Kikoff?

No, Kikoff is transparent and user-friendly. There are no hidden fees, and you won’t incur any interest charges. The monthly payment for the credit line is a minimal $2, and the credit builder loan has a fixed monthly fee of $10.

How long does it take for Kikoff to appear on my credit report?

It may take anywhere from one to six weeks for your new Kikoff account to appear on your credit report. This duration can vary, but rest assured that Kikoff diligently reports your payments to major credit bureaus.

What are alternatives to Kikoff for credit building?

If you’re not completely sold with Kikoff, you can look at Sable One Credit and Credit Strong.

Sable One Credit offers a digital banking solution with a focus on building credit, while Credit Strong specializes in credit builder loans that can help improve your credit score.

Verdict

Users laud the program for its ability to improve credit scores and provide valuable educational resources.

On the flip side, a few users may have felt overwhelmed or wished for more support.

However, Kikoff is committed to constant improvement and has recently introduced personalized payment plans, credit report reviews, and round-the-clock customer service.

Their monthly newsletters also offer tips on maintaining good credit.

Wrap Up

In a world brimming with credit-building options, Kikoff shines as a legitimate and reliable choice. It offers an accessible, budget-friendly path to enhancing your creditworthiness.

There’s no denying that it’s one of the most affordable credit-building services available today.

If you’re ready to take control of your financial future and understand how it works, it’s time to say goodbye to bad credit. Kikoff is a compelling choice you won’t want to miss.